Payroll. Just the word can send shivers down the spines of business owners and managers. It’s a critical function, ensuring employees are paid accurately and on time, but it’s also fraught with complexities – tax regulations, deductions, compliance issues, and the ever-present risk of errors. For many businesses, managing payroll manually, or even with standalone software, becomes increasingly challenging as they grow. This is where Enterprise Resource Planning (ERP) systems with integrated payroll modules step in as a game-changer.

Think of ERP as the central nervous system of your business. It integrates various departments and functions – finance, human resources, supply chain, manufacturing, and, of course, payroll – into a single, unified system. This integration eliminates data silos, streamlines processes, and provides a holistic view of the organization. Implementing an ERP system with a robust payroll module can transform payroll from a tedious, error-prone chore into a strategic function that supports overall business goals.

In this comprehensive guide, we’ll delve into the world of ERP for payroll processing. We’ll explore the features and benefits of integrated payroll, discuss the challenges of ERP adoption, and offer practical advice on how to choose the right ERP solution for your specific needs. I’ll draw on my experience implementing and working with ERP systems to provide real-world insights and lessons learned, helping you navigate the complexities of ERP and unlock the full potential of integrated payroll.

What is ERP for Payroll Processing?

At its core, ERP for payroll processing involves integrating the payroll function into a broader ERP system. Instead of using standalone payroll software, the payroll module within the ERP system shares data and processes with other modules, such as human resources (HR), finance, and accounting. This integration creates a seamless flow of information, reducing the need for manual data entry and reconciliation, and minimizing the risk of errors.

Key Components of an ERP Payroll Module

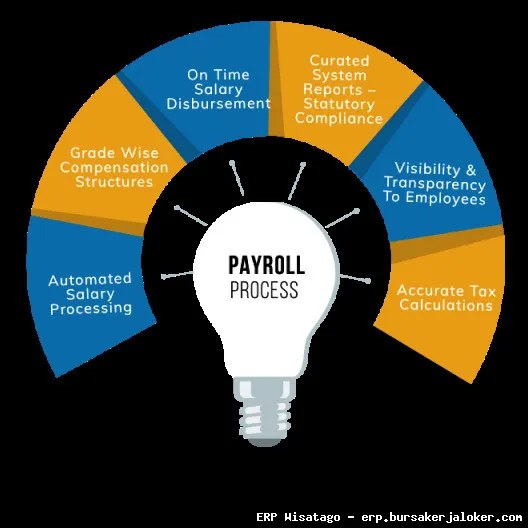

A comprehensive ERP payroll module typically includes the following key components:

- Employee Data Management: Centralized storage and management of all employee information, including personal details, contact information, job titles, salary details, and tax information.

- Payroll Calculation: Automated calculation of gross pay, deductions (taxes, insurance, retirement contributions, etc.), and net pay based on employee data, pay rates, and applicable regulations.

- Tax Management: Automated calculation, withholding, and reporting of federal, state, and local taxes. This includes generating tax forms like W-2s and 1099s.

- Deduction Management: Tracking and managing various deductions, such as health insurance premiums, retirement contributions, and charitable donations.

- Direct Deposit: Facilitating electronic payments to employees’ bank accounts.

- Reporting and Analytics: Generating various payroll reports, such as payroll summaries, tax reports, and labor cost analysis.

- Time and Attendance Integration: Seamless integration with time and attendance systems to accurately track employee work hours and calculate pay.

- Compliance Management: Ensuring compliance with federal, state, and local labor laws and regulations.

Benefits of Using ERP for Payroll

Implementing an ERP system with an integrated payroll module offers numerous benefits compared to using standalone payroll software or manual processes:

Improved Accuracy and Reduced Errors

By automating payroll calculations and data entry, ERP systems significantly reduce the risk of errors. Integrated data eliminates the need to manually transfer information between different systems, minimizing the potential for human error. This leads to more accurate payroll processing and fewer costly mistakes.

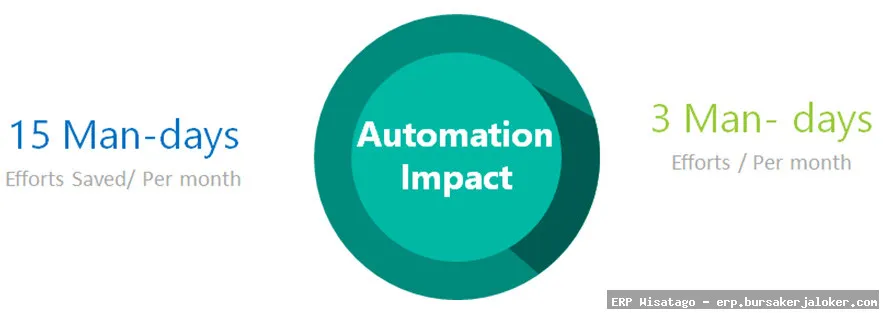

Increased Efficiency and Time Savings

ERP systems streamline payroll processes, automating many tasks that would otherwise be performed manually. This frees up payroll staff to focus on more strategic activities, such as analyzing payroll data and ensuring compliance. The time savings can be significant, especially for larger organizations with complex payroll requirements.

Enhanced Compliance

ERP systems help businesses stay compliant with ever-changing payroll regulations. They automatically calculate and withhold taxes, generate required tax forms, and track employee deductions. Many ERP systems also offer compliance updates and alerts, helping businesses stay informed about changes in the law.

Better Data Visibility and Reporting

ERP systems provide a centralized view of all payroll data, making it easier to generate reports and analyze trends. Businesses can use payroll data to track labor costs, identify areas for improvement, and make informed decisions about staffing and compensation. The ability to generate custom reports allows for deeper insights into payroll performance.

Improved Employee Satisfaction

Accurate and timely payroll is essential for employee satisfaction. By reducing errors and ensuring employees are paid correctly and on time, ERP systems can contribute to a more positive employee experience. This can lead to improved morale, reduced turnover, and increased productivity.

Cost Savings

While the initial investment in an ERP system can be significant, the long-term cost savings can be substantial. By automating payroll processes, reducing errors, and improving efficiency, ERP systems can help businesses save money on labor costs, compliance penalties, and other expenses.

Challenges of ERP Implementation for Payroll

Implementing an ERP system is a complex undertaking, and there are several challenges that businesses may face when integrating payroll:

Data Migration

Migrating data from existing systems to the new ERP system can be a challenging and time-consuming process. It’s crucial to ensure that the data is accurate and complete before migrating it to the ERP system. Data cleansing and validation are essential steps in this process. I’ve seen projects delayed significantly because of underestimated data migration complexities.

System Configuration and Customization

ERP systems are highly configurable, and businesses often need to customize the system to meet their specific needs. This can be a complex process, requiring specialized expertise. It’s important to carefully plan the configuration and customization process to ensure that the system meets the business’s requirements without becoming overly complex or difficult to maintain.

Employee Training

Employees need to be properly trained on how to use the new ERP system. This can be a significant investment, but it’s essential to ensure that employees can effectively use the system and realize its full potential. Consider a phased rollout with extensive training and support for users. Champions within each department can be invaluable.

Integration with Other Systems

Integrating the ERP system with other systems, such as time and attendance systems or benefits administration platforms, can be challenging. It’s important to carefully plan the integration process and ensure that the systems are compatible. API integrations are often the key to seamless data flow.

Resistance to Change

Employees may resist the implementation of a new ERP system, especially if they are comfortable with their existing processes. It’s important to communicate the benefits of the new system and involve employees in the implementation process to address their concerns and build buy-in. Open communication and addressing concerns early are crucial.

Choosing the Right ERP Solution for Payroll

Selecting the right ERP solution is a critical decision that can have a significant impact on the success of the implementation. Here are some factors to consider when choosing an ERP system for payroll processing:

Business Requirements

Clearly define your business requirements and identify the specific features and functionalities that you need in an ERP system. Consider your current and future needs, as well as any industry-specific requirements. A detailed requirements document is essential.

Vendor Reputation and Experience

Research the reputation and experience of different ERP vendors. Look for vendors with a proven track record of successful implementations and a strong understanding of payroll processing. Check references and read online reviews.

Scalability

Choose an ERP system that can scale with your business as it grows. The system should be able to handle increasing transaction volumes and accommodate new users and functionalities. Cloud-based ERP solutions often offer greater scalability.

Integration Capabilities

Ensure that the ERP system can integrate with your existing systems, such as time and attendance systems, benefits administration platforms, and accounting software. Seamless integration is crucial for streamlining processes and avoiding data silos.

Ease of Use

Choose an ERP system that is user-friendly and easy to learn. The system should have an intuitive interface and provide adequate training and support. A system that’s difficult to use will lead to frustration and decreased productivity.

Cost

Consider the total cost of ownership, including software licenses, implementation costs, training costs, and ongoing maintenance and support fees. Compare the costs of different ERP systems and choose the solution that offers the best value for your money. Don’t just focus on the upfront cost; consider the long-term ROI.

Cloud vs. On-Premise

Decide whether you prefer a cloud-based or on-premise ERP system. Cloud-based ERP systems offer greater flexibility and scalability, while on-premise systems provide more control over data and infrastructure. Consider your IT infrastructure and security requirements when making this decision. Cloud solutions often require less internal IT support.

Best Practices for ERP Payroll Implementation

To ensure a successful ERP payroll implementation, follow these best practices:

Plan Thoroughly

Develop a detailed implementation plan that outlines the project scope, timeline, budget, and resources. Involve stakeholders from all departments in the planning process. A well-defined plan is the foundation for a successful implementation.

Assemble a Dedicated Team

Form a dedicated implementation team with representatives from IT, HR, finance, and other relevant departments. Assign clear roles and responsibilities to each team member. A strong and dedicated team is crucial for driving the implementation forward.

Data Cleansing and Validation

Thoroughly cleanse and validate your data before migrating it to the ERP system. Ensure that the data is accurate, complete, and consistent. Garbage in, garbage out – clean data is essential for accurate payroll processing.

Training and Support

Provide comprehensive training and support to employees on how to use the new ERP system. Offer ongoing training and support to address any questions or issues that may arise. Knowledgeable users are essential for realizing the full potential of the system.

Testing and Validation

Thoroughly test and validate the ERP system before going live. Test all payroll processes, including calculations, deductions, and reporting. Identify and resolve any issues before they impact employees. User acceptance testing (UAT) is critical.

Go-Live Strategy

Develop a well-defined go-live strategy. Consider a phased rollout, starting with a pilot group of employees and gradually expanding to the entire organization. This allows you to identify and address any issues before they impact a large number of employees.

Ongoing Monitoring and Maintenance

Continuously monitor and maintain the ERP system after go-live. Regularly review system performance, identify areas for improvement, and apply necessary updates and patches. Proactive monitoring helps prevent problems and ensures optimal performance. Effective IT management often relies on a robust system, RMM allowing for proactive monitoring and maintenance of client infrastructure

.

Conclusion

ERP for payroll processing offers significant benefits for businesses of all sizes. By integrating payroll into a broader ERP system, businesses can improve accuracy, increase efficiency, enhance compliance, and gain better data visibility. While implementing an ERP system can be challenging, following best practices and choosing the right solution can help businesses unlock the full potential of integrated payroll and achieve their business goals. The key is to approach the implementation as a strategic initiative, not just a technology project.

From my experience, the most successful ERP implementations are those where the business clearly defines its requirements, involves stakeholders from all departments, and invests in thorough training and support. Remember that ERP is not a “one-size-fits-all” solution, so it’s crucial to choose a system that aligns with your specific needs and goals. With careful planning and execution, you can transform your payroll process from a burden into a strategic asset.

Ultimately, investing in ERP for payroll processing is an investment in the future of your business. It’s about creating a more efficient, accurate, and compliant payroll process that supports your overall business objectives. By embracing ERP, you can free up valuable resources, reduce risks, and empower your employees to focus on what they do best – driving your business forward.

Frequently Asked Questions (FAQ) about ERP for payroll processing

What are the key benefits of using an ERP system for payroll processing, and how does it improve accuracy and efficiency compared to standalone payroll software?

Implementing an ERP system for payroll processing offers several significant advantages. Firstly, it provides centralized data management, integrating payroll with other business functions like HR, finance, and accounting. This eliminates data silos and reduces the risk of errors associated with manual data entry and transfers between disparate systems. An ERP system fosters better accuracy by automating calculations, deductions, and tax withholdings, minimizing human error and ensuring compliance with ever-changing regulations. Secondly, the increased efficiency stems from automating payroll workflows, such as time and attendance tracking, pay slip generation, and direct deposit processing. This frees up payroll staff to focus on more strategic tasks, such as employee benefits administration and compliance reporting. Finally, improved reporting and analytics capabilities provide valuable insights into labor costs, payroll trends, and compliance risks, enabling better decision-making.

How does an ERP system handle compliance with complex payroll regulations, including tax laws, labor laws, and reporting requirements, across different states or countries?

ERP systems designed for payroll processing are built to handle the complexities of compliance with varying regulations. These systems are regularly updated with the latest tax laws and labor regulations at the federal, state, and even international levels. They automate tax calculations, withholdings, and reporting requirements, ensuring adherence to legal standards. Furthermore, ERP systems offer features to manage labor law compliance, such as tracking employee work hours, overtime, and leave policies. They also generate the necessary reports for regulatory agencies, simplifying the reporting process and reducing the risk of penalties. Many ERP solutions offer localization features that adapt to the specific requirements of different states or countries, managing currency conversions, language preferences, and local tax rules, simplifying multi-national payroll management. Regular updates from the ERP vendor are vital to maintain compliance as laws evolve.

What are the key features to look for when choosing an ERP system specifically for payroll processing, and how do these features contribute to a successful payroll implementation?

When selecting an ERP system for payroll, several key features are crucial for successful implementation. Look for robust time and attendance tracking capabilities to accurately record employee work hours and manage leave requests. Automated payroll calculations are essential for ensuring accurate wage calculations, deductions, and tax withholdings. Strong reporting and analytics tools provide insights into payroll costs, trends, and compliance risks. Integration with other modules, such as HR and finance, streamlines data flow and reduces data silos. Compliance management features help ensure adherence to tax laws, labor regulations, and reporting requirements. Employee self-service portals empower employees to access pay stubs, update personal information, and manage their benefits, reducing administrative burden. A user-friendly interface and comprehensive training resources contribute to user adoption and a smooth implementation process. Finally, ensure the system offers robust security features to protect sensitive employee data.