Expense management. Just the words can send shivers down the spines of finance teams and employees alike. For far too long, it’s been a manual, often frustrating process riddled with spreadsheets, paper receipts, and the constant threat of errors. But what if I told you there was a better way? A way to automate, streamline, and gain true visibility into your company’s spending? That’s where ERP (Enterprise Resource Planning) systems come into play, transforming expense management from a headache into a strategic advantage.

Having been involved in several ERP implementations over the years, I’ve seen firsthand the dramatic impact a well-chosen and configured system can have on a business’s bottom line and employee morale. Expense management is often one of the first areas targeted for improvement during an ERP rollout, and for good reason. The potential for cost savings, increased efficiency, and improved compliance is significant. Think about it: no more lost receipts, no more manual data entry, and real-time insights into spending patterns. This allows for better budgeting, forecasting, and overall financial control.

This guide will delve into the world of ERP for expense management, covering everything from the core features and benefits to the challenges of implementation and how to choose the right solution for your specific needs. We’ll explore how an ERP system can automate expense report creation, simplify approval workflows, ensure policy compliance, and provide powerful analytics to help you make smarter financial decisions. Consider this your comprehensive roadmap to understanding and leveraging the power of ERP to revolutionize your expense management processes.

What is ERP for Expense Management?

ERP for expense management is a module or set of features within a broader ERP system that automates and streamlines the process of tracking, reporting, and reimbursing employee expenses. Instead of relying on manual processes and disparate systems, ERP expense management integrates seamlessly with other core business functions like finance, accounting, and human resources. This integration provides a single source of truth for all financial data, improving accuracy, efficiency, and visibility.

Key Benefits of ERP Expense Management

Implementing ERP for expense management offers a multitude of advantages, impacting various aspects of your organization. Here are some of the most significant benefits:

- Automation: Automates tasks such as expense report creation, data entry, and approval workflows, significantly reducing manual effort and saving time.

- Improved Accuracy: Minimizes errors associated with manual data entry and calculations, leading to more accurate financial reporting.

- Real-time Visibility: Provides real-time insights into spending patterns, allowing for better budgeting, forecasting, and cost control.

- Policy Compliance: Enforces company expense policies automatically, reducing the risk of fraud and non-compliance.

- Simplified Reporting: Generates comprehensive reports on expenses, providing valuable data for analysis and decision-making.

- Faster Reimbursements: Streamlines the reimbursement process, ensuring employees are paid promptly and accurately.

- Enhanced Audit Trails: Creates detailed audit trails of all expense transactions, simplifying audits and ensuring accountability.

- Mobile Accessibility: Allows employees to submit expenses on the go using mobile devices, improving convenience and efficiency.

Core Features of ERP Expense Management

A robust ERP expense management module typically includes a range of features designed to streamline and automate the entire expense lifecycle. Here’s a look at some of the core functionalities:

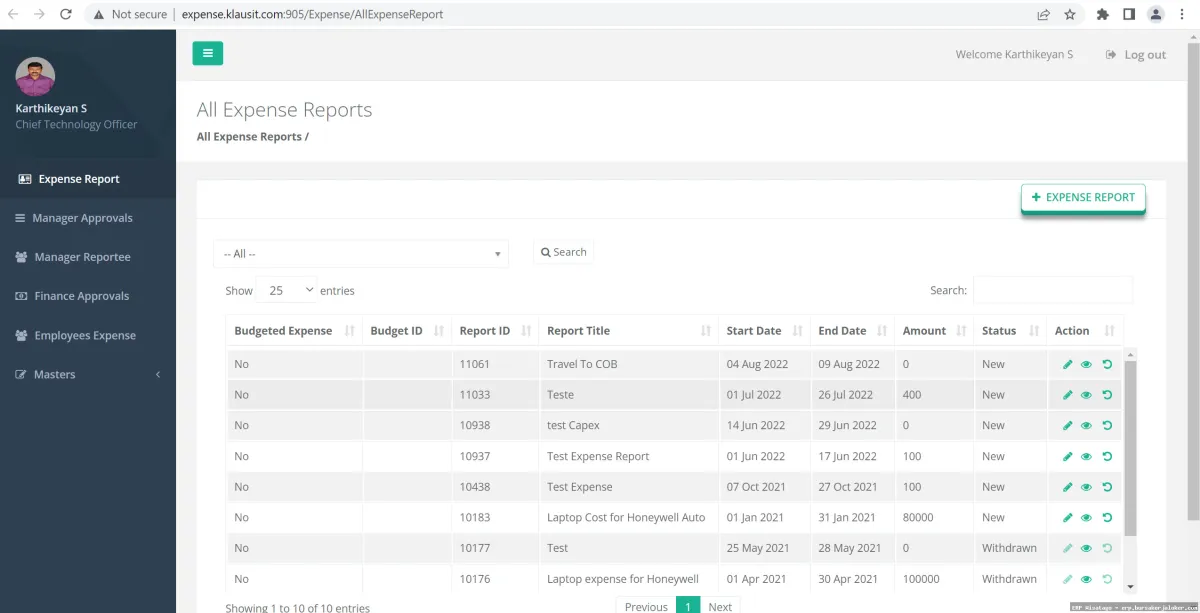

Expense Report Creation and Submission

This feature allows employees to easily create and submit expense reports electronically. They can typically capture receipt images using their mobile devices, automatically extract relevant information, and categorize expenses according to predefined categories. The system should also allow for the allocation of expenses to specific projects, departments, or cost centers.

Approval Workflows

Automated approval workflows ensure that expense reports are reviewed and approved by the appropriate managers or supervisors. The system can be configured to route expense reports based on pre-defined rules, such as expense type, amount, or department. Managers can review and approve expense reports electronically, adding comments or rejecting them if necessary. Email notifications keep everyone informed of the status of their expense reports.

Receipt Management

Effective receipt management is crucial for accurate expense tracking and compliance. ERP systems typically offer features such as optical character recognition (OCR) to automatically extract data from receipts, digital storage of receipts, and the ability to attach receipts to expense reports. This eliminates the need for paper receipts and simplifies the audit process.

Policy Enforcement

ERP systems can be configured to enforce company expense policies automatically. This includes setting spending limits for different expense categories, restricting certain types of expenses, and requiring specific documentation for certain transactions. The system can also flag expenses that violate company policy, alerting managers to potential issues.

Payment and Reimbursement

Once an expense report is approved, the ERP system can automatically initiate the reimbursement process. This may involve integrating with the company’s payroll system or issuing payments directly to employees’ bank accounts. The system should also track reimbursement amounts and provide detailed payment information to employees.

Reporting and Analytics

Robust reporting and analytics capabilities are essential for gaining insights into spending patterns and identifying areas for cost savings. ERP systems typically offer a range of pre-built reports, as well as the ability to create custom reports based on specific needs. These reports can provide valuable information on expense trends, employee spending habits, and overall cost performance.

Integration with Other ERP Modules

The real power of ERP expense management lies in its integration with other ERP modules, such as finance, accounting, and HR. This integration ensures that all financial data is consistent and accurate, and that expense information is readily available for reporting and analysis. For example, expense data can be automatically integrated into the general ledger, providing a complete picture of the company’s financial performance.

Challenges of Implementing ERP Expense Management

While ERP expense management offers numerous benefits, implementing a new system can be challenging. Here are some common hurdles to be aware of:

Data Migration

Migrating data from existing systems to the new ERP system can be a complex and time-consuming process. It’s important to carefully plan the data migration process and ensure that data is accurate and complete. Data cleansing and validation are crucial steps to avoid importing errors into the new system.

User Adoption

Getting employees to adopt a new system can be a challenge, especially if they are used to manual processes. Proper training and communication are essential to ensure that employees understand the benefits of the new system and how to use it effectively. It’s also important to address any concerns or resistance to change.

Customization

While ERP systems offer a wide range of features, some companies may require customization to meet their specific needs. However, excessive customization can increase the cost and complexity of implementation. It’s important to carefully evaluate the need for customization and to work with a qualified ERP consultant to ensure that customizations are implemented correctly.

Integration with Existing Systems

Integrating the ERP system with other existing systems, such as payroll or travel booking systems, can be complex. It’s important to ensure that the ERP system is compatible with existing systems and that data can be exchanged seamlessly between them.

Cost

Implementing an ERP system can be a significant investment. It’s important to carefully evaluate the costs and benefits of the system and to choose a solution that fits your budget. Don’t just focus on the initial purchase price; consider the ongoing costs of maintenance, support, and upgrades.

Choosing the Right ERP Expense Management Solution

Selecting the right ERP expense management solution is a critical decision that can significantly impact your organization’s efficiency, profitability, and compliance. Here are some key factors to consider:

Business Requirements

Start by clearly defining your business requirements. What are your specific pain points with your current expense management process? What features and functionalities are essential for your organization? Consider the size of your company, the complexity of your expense policies, and your industry-specific needs.

Scalability

Choose an ERP system that can scale with your business as it grows. The system should be able to handle increasing volumes of data and transactions without performance degradation. It should also be able to adapt to changes in your business processes and regulations.

Integration Capabilities

Ensure that the ERP system can integrate seamlessly with your existing systems, such as accounting software, HR systems, and travel booking platforms. A well-integrated system will streamline data flow and eliminate the need for manual data entry.

User-Friendliness

Choose an ERP system that is user-friendly and easy to learn. A system that is difficult to use will lead to low user adoption and decreased productivity. Look for a system with a clear and intuitive interface.

Vendor Reputation and Support

Select a reputable ERP vendor with a proven track record of success. Consider the vendor’s experience in your industry and their ability to provide ongoing support and maintenance. Read online reviews and talk to other customers to get a sense of the vendor’s reputation. For more information, you can refer to RMM as an additional resource.

Cost and ROI

Evaluate the total cost of ownership of the ERP system, including software licenses, implementation costs, training costs, and ongoing maintenance fees. Compare the costs of different solutions and calculate the potential return on investment (ROI) based on factors such as reduced processing costs, improved accuracy, and increased efficiency.

Lessons Learned from ERP Implementations

Having been through several ERP implementations, I’ve learned a few valuable lessons that can help ensure a successful project:

- Executive Sponsorship is Crucial: A successful ERP implementation requires strong leadership and support from senior management. Executive sponsorship helps to ensure that the project receives the necessary resources and attention.

- Don’t Underestimate Change Management: Implementing an ERP system is a significant change for any organization. It’s important to have a comprehensive change management plan in place to help employees adapt to the new system and processes.

- Data Cleansing is Essential: Garbage in, garbage out. Take the time to cleanse and validate your data before migrating it to the new system. This will help to ensure data accuracy and prevent errors.

- Thorough Testing is Key: Test the system thoroughly before going live. Involve users from different departments in the testing process to ensure that the system meets their needs.

- Training, Training, Training: Provide comprehensive training to all users. Offer different types of training, such as classroom training, online tutorials, and hands-on workshops.

- Go-Live Support is Critical: Provide adequate support during and after the go-live period. Have a dedicated support team available to answer questions and resolve issues.

- Continuous Improvement: ERP implementation is not a one-time event. Continuously monitor the system’s performance and make improvements as needed.

The Future of ERP Expense Management

The future of ERP expense management is bright, with advancements in technology driving even greater efficiency and automation. We can expect to see increased use of artificial intelligence (AI) and machine learning (ML) to automate tasks such as receipt processing, fraud detection, and policy enforcement. Mobile technology will continue to play a significant role, with employees able to submit expenses, track mileage, and manage approvals from their smartphones or tablets. Cloud-based ERP solutions will become even more prevalent, offering greater flexibility, scalability, and cost savings. The focus will continue to shift towards providing real-time insights and analytics, empowering businesses to make data-driven decisions and optimize their spending.

In conclusion, ERP for expense management is a powerful tool that can transform your organization’s financial processes, improve efficiency, and reduce costs. By carefully considering your business requirements, choosing the right solution, and implementing it effectively, you can unlock the full potential of ERP and gain a competitive advantage.

Frequently Asked Questions (FAQ) about ERP for expense management

How does an ERP system help automate and streamline the expense management process for my business?

An Enterprise Resource Planning (ERP) system significantly automates and streamlines expense management by integrating it with other core business functions like accounting and finance. This integration allows for automated data capture of expenses through various methods, such as mobile apps for receipt scanning and direct feeds from corporate credit cards. Approval workflows can be customized within the ERP to route expense reports to the appropriate managers for review and authorization. Once approved, the system automatically posts the expenses to the general ledger, eliminating manual data entry and reducing errors. Furthermore, ERP systems often include features for policy enforcement, ensuring that all submitted expenses comply with company guidelines, thereby minimizing compliance risks and improving overall efficiency.

What are the key benefits of using ERP software specifically for managing employee expenses and travel reimbursements?

Utilizing ERP software for managing employee expenses and travel reimbursements offers numerous benefits. First, it provides enhanced visibility into spending patterns, allowing businesses to identify areas for cost reduction and negotiate better rates with vendors. Secondly, it improves accuracy and reduces fraud by automating expense tracking and enforcing pre-defined spending policies. Automated workflows also accelerate the reimbursement process, leading to increased employee satisfaction. Moreover, the integrated nature of ERP ensures compliance with tax regulations and reporting requirements, reducing the risk of penalties. Finally, by centralizing all expense data within the ERP system, businesses gain valuable insights that can inform strategic decision-making and improve overall financial performance. Real-time analytics and reporting capabilities also help track key performance indicators (KPIs) related to expense management.

What features should I look for in an ERP system to ensure effective expense report automation and policy compliance?

When selecting an ERP system for effective expense report automation and policy compliance, consider several key features. Look for mobile expense management capabilities that allow employees to submit expenses on the go by capturing receipts and filling out forms. Automated workflow features are crucial for routing expense reports through the approval process efficiently. The system should also provide robust policy enforcement rules, allowing administrators to define spending limits, require specific documentation, and flag out-of-policy expenses. Integration with corporate credit cards and bank feeds is essential for automatically capturing transaction data. Finally, reporting and analytics capabilities should provide insights into spending patterns, policy compliance rates, and potential areas for cost savings. Furthermore, ensure the ERP integrates with your existing accounting software for seamless financial reconciliation.